The top cause of insurance claims is mental illness

The top cause of insurance claims is mental illness. According to a new study conducted in the UK, two-thirds of British adults said they have experienced mental ill-health at some point in their lives. The survey revealed that on average 70% of people between the ages of 18 and 54 have experienced a mental health problem. In all, 65% of all the people surveyed, said they had experienced some form of mental health problem. [1]

Britain’s high stress, long-hours work culture has led to a higher level of people out of work with mental health problems than any other country in the developed world. [2]

Furthermore, a different study has shown that approximately 53% of NHS patients displayed clinical symptoms of depression and anxiety within a year after completing psychological treatments. Over half of these were found to have suffered a relapse event, with up to 79% of events occurring within the first six months after treatment.[3]

The economic cost

According to an OECD report, people unable to work because of mental health issues cost the UK economy £70 billion each year with 40% of all people claiming disability benefits is due to psychological issues.[2]

Top cause of insurance claims

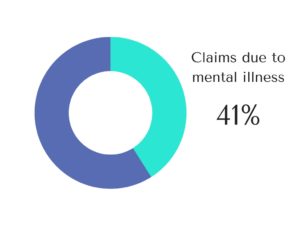

The top cause of insurance claims are mental health issues, which have remained at the top of the list since 1999, far above other claims such as back injury or stroke.[4]

According to an analysis by the Institute for Fiscal Studies, nearly half of all people claiming disability benefit are doing so because they have a mental illness rather than a physical condition. [5]

The analysis reveals that the proportion of disability claims which are related to mental illness has risen from 27 per cent to 41 per cent since 1999. [5]

In fact, six in ten claims by those aged between 25 and 34 are now related to mental illness, up from half in 1999. [5]

In a recent interview, Vanessa Sallows, Benefits and Governance Director at Legal & General’s Group Protection, said: “Mental health continues to be the main reason for absences on our group income protection. [4]

mHealth technology is here to help

Smartphones and wearables

In the UK alone, there are over 40 million smartphone users over 3 million people utilise some type of wearable device.

Mobile health technology

mHealth technology uses connected devices to help prevent illness, improve compliance and get people back to health.

Customer centricity

mHealth technology puts customers at the centre, where they want to be, and helps them to live the lives they want.

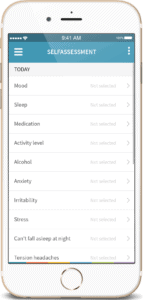

The Monsenso mHealth solution for mental health can be used by insurance companies to offer a preventive, mental wellness programme.

Policyholders can use the Monsenso smartphone app to enter their daily levels of stress, anxiety, irritability, physical activity and number of hours they slept. This information is gathered and stored electronically so it can be accessed by a coach or telehealth consultant, anytime, anywhere.

In this way, the coach or telehealth consultant can remotely monitor policyholders and follow up with those users who present any triggers or warning signs. For example, the the coach or telehealth consultant will be notified when a policyholder indicates a high level of stress, anxiety and irritability for more than five consecutive days or when someone sleeps less than six hours for more than three consecutive days. These two actions would be considered indicators that the individual needs to be contacted for a “wellness check” and implement the necessary measures to prevent the person from going on long-term leave, or become affected by other physical conditions such as heart disease.

References:

[1] Two-thirds of Britons have had mental health problems. The Guardian. Haroon Siddiqi. (2017, May 8)

https://www.theguardian.com/society/2017/may/08/two-thirds-of-britons-have-had-mental-health-problems-survey?CMP=share_btn_tw

[2] British workers among the most stressed in the world. The Telegraph. Georgia Graham. (2014, Feb 14)

http://www.telegraph.co.uk/news/health/10629374/Over-a-million-people-with-mental-health-issues-are-out-of-work-and-claiming-benefits.html

[3] More than half of NHS patients display symptoms of relapse after depression treatments, study finds. News Medical Life Science. (2017 May 3)

http://www.news-medical.net/news/20170503/More-than-half-of-NHS-patients-display-symptoms-of-relapse-after-depression-treatments-study-finds.aspx?showform=printpdf

[4] Legal & General group protection payouts rise. FT Adviser. Simoney Kyriakou. (2017, May 2).

https://www.ftadviser.com/protection/2017/05/02/legal-general-group-claim-payouts-rise/

[5] Nearly half disability benefit claimants have a mental illness. The Telegraph. (2015, May 21)

http://www.telegraph.co.uk/news/health/11622166/Nearly-half-disability-benefit-claimants-have-a-mental-illness.html